Charity & Donation Scams

Learn how to verify legitimate charities and ensure your generous donations reach those truly in need.

What are Charity & Donation Scams?

Charity scams occur when fraudsters pose as legitimate charitable organizations to steal money from well-meaning donors.

These scammers exploit people's natural desire to help others, especially during crises like natural disasters, humanitarian emergencies, or high-profile tragedies. They create convincing fake charities or impersonate real ones to collect donations that never reach intended beneficiaries.

Charity scams typically involve:

- Creating fake charities with names similar to legitimate organizations

- Impersonating real charities through websites, emails, or phone calls

- Exploiting recent disasters or emotional causes

- Making vague claims about how donations will be used

- Pressuring potential donors to give immediately

Common Types of Charity & Donation Scams

These scams appear in several forms, each designed to exploit your generosity:

Disaster Relief Scams

Fake charities appear immediately after natural disasters like hurricanes, earthquakes, or wildfires.

These scammers take advantage of widespread media coverage and the natural desire to help disaster victims.

Charity Impersonation

Scammers create websites, emails, or social media profiles that mimic legitimate well-known charities.

They often use names, logos, and branding that are nearly identical to real organizations, with subtle differences.

Emotional Appeal Scams

These focus on highly emotional causes like helping sick children, veterans, or endangered animals.

They often use heartbreaking stories and images to create strong emotional responses that can cloud judgment.

Donation Matching Scams

Fraudsters claim that your donation will be matched or multiplied by a generous sponsor or organization.

This creates a false sense of increased impact to encourage larger donations.

Pop-up Charities

These are temporary organizations created for a specific event or cause with no real infrastructure or track record.

They disappear after collecting donations, making it impossible to verify how funds were used.

Volunteer Opportunity Scams

These request fees for volunteer "opportunities" or training programs that don't actually exist.

They may also collect personal information that can be used for identity theft.

Why Charity Scams Target Older Adults

Seniors are frequently targeted by charity scammers for several specific reasons:

Demographic Factors

Generational Giving Habits

Older adults tend to be more charitable and often have established giving patterns to causes they care about.

Available Resources

Many seniors have retirement funds, home equity, or stable incomes that make them attractive targets for fraudsters.

Life Experience

Many older adults have lived through significant historical events and may feel more connected to certain causes like veteran support or medical research.

Psychological Factors

Heightened Empathy

Many seniors have strong desires to help others and leave positive legacies, making emotional appeals particularly effective.

Unfamiliarity With Verification Methods

Some older adults may be less familiar with charity verification tools and online resources for checking legitimacy.

Trust in Authority

Seniors who grew up in an era of higher social trust may be more inclined to believe official-sounding organizations.

How Scammers Exploit Good Intentions

Charity scammers use specific tactics to manipulate donors:

- Creating a sense of urgency with "limited time" matching opportunities

- Using emotional manipulation with heartbreaking stories and images

- Building false rapport by referencing values or religious beliefs

- Highlighting problems that resonate strongly with older generations

- Making vague promises about how donations will be used

- Providing fake testimonials from supposed beneficiaries

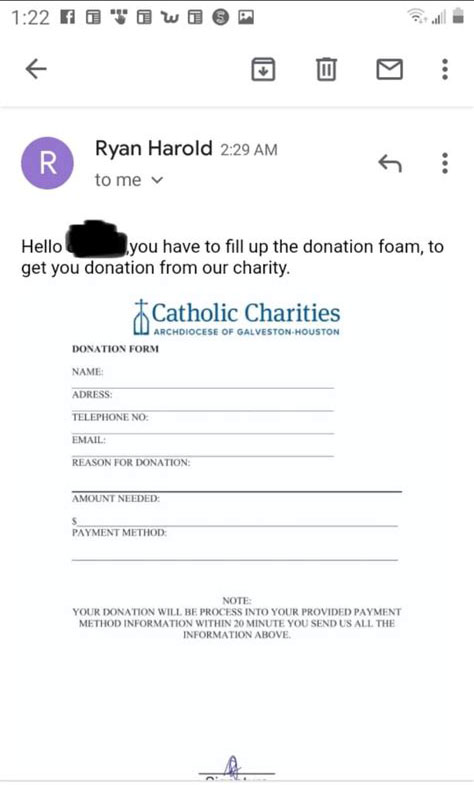

Anatomy of a Charity Scam: Red Flags to Watch For

Let's examine a typical charity scam solicitation to identify the warning signs:

Warning Signs in This Solicitation

Copycat Organization Name

The organization has a name very similar to a well-known charity but with subtle differences: "International Children's Relief Fund" instead of a legitimate organization like "Save the Children."

Urgent Deadline

"Donation matching ends at midnight tonight!" creates artificial time pressure to prevent research or verification.

Vague Descriptions

Notice how the solicitation makes broad claims about "helping children in crisis zones" without specific details about programs, locations, or impact measurements.

Unusual Payment Methods

The solicitation emphasizes wire transfers, gift cards, or cryptocurrency donations, which are difficult to trace or recover.

No Transparency

There's no mention of financial transparency, annual reports, or how funds are allocated between programs and administrative costs.

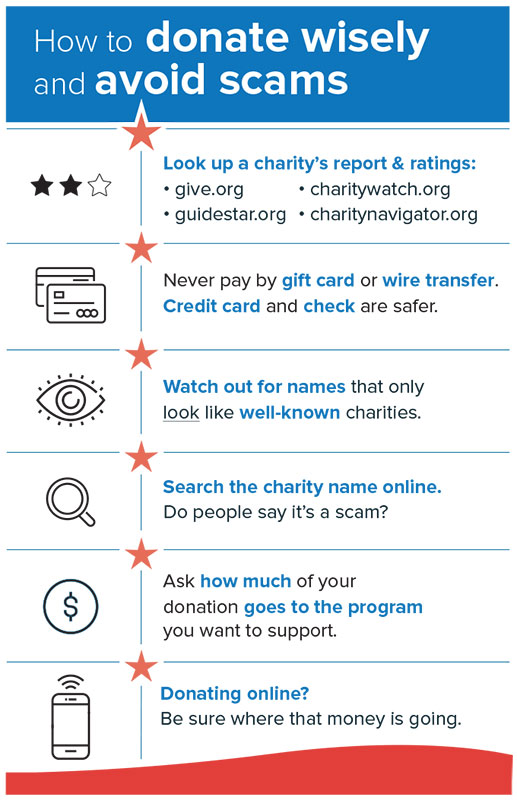

How to Protect Yourself from Charity Scams

Follow these practices to ensure your donations reach legitimate organizations:

Research Before Donating

Search for the charity's name plus words like "complaint," "review," or "scam" to see if others have reported issues with the organization.

Verify Legitimacy

Check if the charity is registered with the IRS and listed on charity watchdog sites like Charity Navigator, GuideStar, or the Better Business Bureau's Wise Giving Alliance.

Contact Directly

If you're contacted by a charity, hang up and call them back using the phone number from their official website—not the number provided in the solicitation.

Ask Specific Questions

Ask how much of your donation will directly support programs vs. administrative costs, and request specific examples of the charity's work and achievements.

Use Secure Payment Methods

Donate using credit cards or checks made out to the organization (not individuals) which provide better protection and records of your donation.

Reject Pressure Tactics

Legitimate charities will welcome your donation tomorrow just as much as today. Don't be rushed by high-pressure appeals or "limited time" offers.

The Golden Rule for Charitable Giving

Always verify a charity's legitimacy through independent sources before donating, no matter how urgent or emotional the appeal may be.

Charity Verification Resources

Use these trusted tools to verify charitable organizations:

Charity Navigator

Provides ratings for charities based on financial health, accountability, and transparency.

Visit Website

GuideStar (Candid)

Offers information on nonprofit organizations' missions, legitimacy, impact, reputation, and finances.

Visit Website

BBB Wise Giving Alliance

Evaluates charities against comprehensive standards for accountability and ethical practices.

Visit Website

CharityWatch

Provides independent ratings and information to help maximize the effectiveness of charitable giving.

Visit Website

IRS Tax Exempt Organization Search

Confirm if a charity is a registered 501(c)(3) organization eligible to receive tax-deductible contributions.

Visit Website

FTC Charity Scams Information

Provides resources on avoiding charity scams and reporting suspected fraudulent organizations.

Visit WebsiteUsing These Resources:

- Enter the exact name of the charity you're researching

- Review the organization's transparency rating and financial information

- Check what percentage of donations go to programs vs. administration

- Look for information about the charity's leadership and governance

- Read reviews and complaints from other donors if available

Remember: If a charity doesn't appear in any of these databases, that's a significant red flag.

Red Flags of Fake Charities

Watch for these warning signs when evaluating charitable organizations:

Organization Red Flags

Copycat Names and Lookalike Websites

Names that sound similar to well-known charities but with slight variations. Always check the exact spelling and URL.

Lack of Transparency

No clear mission statement, detailed program information, financial reports, or information about leadership.

No 501(c)(3) Status

Legitimate U.S. charities should be registered as tax-exempt organizations with the IRS and provide an EIN (Employer Identification Number).

No Physical Address

Only providing a P.O. box or no address at all. Legitimate charities typically have verifiable physical locations.

Solicitation Red Flags

High-Pressure Tactics

Using guilt, urgency, or aggressive sales techniques to pressure you into donating immediately.

Vague Use of Funds

Unable to explain specifically how donations will be used or making guarantees that 100% goes to the cause (which is rarely possible due to operational costs).

Unusual Payment Methods

Requesting donations via wire transfer, gift cards, cryptocurrency, or cash. Legitimate charities typically accept checks, credit cards, and online payments.

Thank You for Previous Donations

Claiming you've donated before when you haven't. This is a common tactic to create a false sense of familiarity.

Smart Giving Strategies

Follow these best practices to make your charitable giving both safe and effective:

Create a Giving Plan

Decide which causes matter most to you and research reputable organizations in those areas before disaster strikes or appeals arrive.

Check Track Records

Focus on established charities with proven histories of work in their field rather than new organizations with no track record.

Initiate the Donation

Instead of responding to solicitations, visit the charity's official website directly to make donations on your own terms and timeline.

Keep Records

Maintain records of all donations, including receipts and acknowledgment letters, for tax purposes and to track your giving history.

Schedule Regular Giving

Consider setting up recurring donations to your chosen charities rather than responding to one-time emotional appeals.

Consider Local Impact

Local charities often have lower administrative costs and provide services directly to your community where you can see the impact.

Financial Advice for Charitable Giving

- Set an annual charitable giving budget and stick to it

- Consider donating through a donor-advised fund for tax advantages and simplified giving

- Explore matching gift programs through your employer

- Consider qualified charitable distributions from IRAs if you're over 70½ (consult a financial advisor)

- Research potential tax benefits from your donations

- Be aware that donations to individuals (like GoFundMe campaigns) are generally not tax-deductible

Special Considerations: Crowdfunding & Disaster Giving

These situations require extra caution when donating:

Crowdfunding Campaigns

Platforms like GoFundMe, Kickstarter, and Facebook Fundraisers have made person-to-person fundraising easier, but they also create opportunities for scammers.

Crowdfunding Safety Tips:

- Donate only to campaigns organized by people you personally know and trust

- Be skeptical of campaigns with limited information about the organizer

- Look for transparent updates and specific details about how funds will be used

- Check if the campaign is being shared by trusted mutual connections

- Be aware that most crowdfunding platforms have limited verification processes

- Understand that donations to individuals are typically not tax-deductible

- Remember that legitimate causes can use established charities for fundraising

Disaster Relief Donations

Natural disasters and major crises generate immediate emotional responses and a flood of charitable appeals, both legitimate and fraudulent.

Disaster Giving Tips:

- Give to established disaster relief organizations with pre-existing operations in the affected region

- Be wary of new organizations formed specifically in response to the current disaster

- Avoid organizations that pressure you to donate immediately

- Research how the charity responded to previous disasters

- Understand that money is typically more useful than donated goods during disaster response

- Consider supporting both immediate relief and longer-term rebuilding efforts

- Check resources like FEMA's voluntary organization list or National VOAD (Voluntary Organizations Active in Disaster) for verified disaster response organizations

When Charity Gets Personal

With personal fundraisers and crowdfunding, remember:

- There's often minimal vetting of personal fundraising campaigns

- The person or cause might be legitimate, but the fundraiser could be unauthorized

- Some platforms offer more protection than others - research their verification processes

- If you want to help someone personally, consider giving directly to them or to service providers (like hospitals or funeral homes) on their behalf

What to Do If You've Been Scammed

If you discover you've donated to a fraudulent charity:

Immediate Steps

- Contact your financial institution immediately if you paid by credit card or electronic payment. They may be able to stop or reverse the charge.

- Report the theft to local law enforcement and get a police report, especially for substantial donations.

- Change passwords for your financial accounts if you provided any login information.

- Document everything, including the charity's name, contact information, what they told you, and how much you donated.

- Check for additional charges or suspicious activity on your accounts, as scammers may attempt further fraud.

Report the Charity Scam

Report the fraudulent charity to these agencies to help protect others:

- Federal Trade Commission (FTC): reportfraud.ftc.gov or call 1-877-FTC-HELP

- FBI Internet Crime Complaint Center (IC3): www.ic3.gov

- Your state's charity regulator: Usually the Attorney General's office or Department of Consumer Affairs

- National Center for Disaster Fraud (for disaster-related charity scams): www.justice.gov/disaster-fraud

- Better Business Bureau's Scam Tracker: www.bbb.org/scamtracker

Beware of Recovery Scams

After being scammed, you might be targeted by "recovery services" claiming they can help get your money back for a fee. These are typically secondary scams. Legitimate recovery assistance usually doesn't require upfront payment.

Helping Others Avoid Charity Scams

Share your knowledge to protect friends and family:

For Family and Friends

- Share information about established, reputable charities in causes they care about

- Offer to research organizations before they donate, especially for elderly family members

- Share verification resources like Charity Navigator and GuideStar

- Forward alerts about known charity scams from trusted sources

- During disasters, suggest reputable relief organizations with proven track records

- Create a family giving plan that focuses on established charities

- Gently question if someone mentions donating to an organization with red flags

For Your Community

- Share information about charity scams at community centers, places of worship, or senior centers

- Distribute our printable charity verification checklist

- Report suspicious charity solicitations to local authorities

- Post reputable disaster relief options on neighborhood social media during crises

- Organize a community presentation on smart charitable giving

- Partner with local organizations to spread awareness

- Create a list of vetted local charities for your community

Discussing Charity Scams Respectfully

When talking about charity scams with others:

- Focus on the sophistication of scammers rather than suggesting vulnerability

- Emphasize that even smart, savvy people can be deceived by professional fraudsters

- Share your own verification practices as helpful tips rather than directives

- Acknowledge the good intentions behind wanting to help causes

- Suggest alternatives rather than simply saying "don't donate"

- Provide specific, actionable verification steps rather than general warnings

Unsure About a Charitable Organization?

If you're concerned about a charity's legitimacy or believe you've encountered a scam, we're here to help.