Learn About Online Scams

Understanding how scams work is your first line of defense. Learn to recognize the warning signs and protect yourself.

Universal Red Flags: Warning Signs of Any Scam

No matter what type of scam you encounter, these warning signs should immediately raise your suspicion:

Creates a Sense of Urgency

"Act now or lose your chance!" Scammers push you to make decisions quickly without time to think.

Requests Unusual Payment Methods

Gift cards, wire transfers, cryptocurrency, or money orders are requested instead of normal payment methods.

Sounds Too Good to Be True

Unexpected money, prizes, or opportunities that seem unrealistically generous.

Asks for Personal Information

Requests for Social Security numbers, account details, or passwords when there's no legitimate reason.

Unexpected Contact

Messages or calls claiming to be from companies or agencies you don't have a relationship with.

Poor Grammar or Spelling

Official organizations rarely send messages with obvious language errors.

Types of Online Scams Targeting Seniors

Click on each category to learn how these scams work and how to protect yourself online.

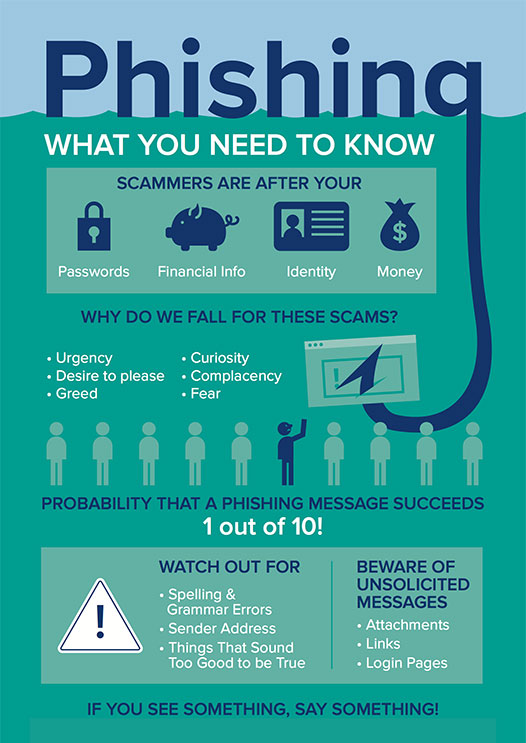

Phishing & Identity Theft

Messages that trick you into revealing personal information by pretending to be from trusted organizations.

Learn about phishing scams →

Family & Emergency Scams

Calls claiming your loved one is in trouble and needs money immediately for an emergency.

Learn about emergency scams →

Financial & Banking Scams

Fake alerts about your accounts that try to gain access to your financial information.

Learn about banking scams →

Government Impersonation

Scammers pretending to be from tax agencies, Social Security, or other government departments.

Learn about government scams →

Tech Support Scams

Calls or pop-ups claiming your computer has a problem they can fix for a fee.

Learn about tech support scams →

Shopping & Marketplace Scams

Fake websites, counterfeit products, and subscription traps that steal your money.

Learn about shopping scams →

Investment & Financial Opportunity

Get-rich-quick schemes, fake investments, and pyramid schemes promising big returns.

Learn about investment scams →

Charity & Donation Scams

Fake charities that play on your emotions after disasters or for causes that don't exist.

Learn about charity scams →

Romance & Relationship Scams

False relationships built online to gain your trust before asking for money.

Learn about romance scams →

Prize, Lottery & Sweepstakes Scams

Notifications that you've won something but need to pay fees or taxes to collect.

Learn about lottery scams →

Employment & Income Opportunity Scams

Fake job offers requiring you to pay upfront or share personal information.

Learn about employment scams →

Housing & Travel Scams

Fake vacation rentals, timeshare schemes, and non-existent property listings.

Learn about travel scams →Featured Scam Breakdown: Phishing

Let's take a closer look at one of the most common scams targeting seniors today.

How to Spot a Phishing Email

Check the Sender's Email Address

Look carefully at the sender's email. It might look similar to a real company but have small differences like "amazon-support.net" instead of "amazon.com".

Beware of Urgent Messages

Phrases like "Immediate action required" or "Your account will be suspended" are designed to make you panic and act without thinking.

Hover Before You Click

Place your mouse over any links (without clicking) to see where they really go. The destination might be completely different from what's shown.

Look for Impersonal Greetings

Legitimate companies usually use your name. "Dear Customer" or "Dear Account Holder" suggests the sender doesn't actually know who you are.

Universal Protection Strategies for Seniors

These simple habits can protect you from most types of online scams.

Verify Independently

Never use the contact information provided in a suspicious message. Look up the organization's phone number or website yourself.

Refuse Urgent Requests

Legitimate organizations won't demand immediate action. Take your time to verify any request for personal information or money.

Ask for Opinions

Before responding to suspicious contacts, ask a trusted friend or family member for their perspective.

Keep Software Updated

Regularly update your devices and anti-virus software to protect against the latest threats.

Don't Share Too Much

Be cautious about the personal information you share online, especially on social media platforms.

Stay Informed

Check our Scam Alerts page regularly to learn about new scams targeting seniors in your area.

Need Help With a Potential Scam?

If you think you've encountered an online scam or may have already been a victim, we're here to help.

In emergency situations involving financial loss, call your bank or credit card company immediately.

Related Resources for Senior Online Safety

Common Questions About Online Scams

Get answers to frequently asked questions about protecting yourself from internet fraud.

-

How can I tell if a website is legitimate or a scam?

Look for these trust indicators: a secure website address (https:// with a padlock icon), professional design without spelling or grammar errors, a clear "About Us" page with verifiable contact information, secure payment options, and clearly stated privacy and return policies. Be cautious of sites with extremely low prices, limited contact options, or poorly written content. When in doubt, search for reviews of the website and the company name plus "scam" to see if others have reported issues.

-

Why do scammers target seniors specifically?

Scammers often target seniors for several reasons: many older adults have built up savings and home equity over their lifetime, may be less familiar with digital technology, tend to be more trusting and polite (making it harder to say "no"), may be more isolated and eager for social connection, and are less likely to report fraud due to embarrassment or fear of losing independence. Understanding these tactics can help you recognize and avoid scams.

-

What should I do if I receive a suspicious email from my bank?

Never click links or respond directly to the email. Instead, contact your bank using the phone number on your bank card or statement (not from the email). Most banks never ask for personal information via email. When in doubt, visit your local branch in person. Keep the suspicious email but don't interact with it, as it may help authorities track scammers if you report it.

-

Is it safe to shop online with my credit card?

Yes, when done properly. Use credit cards (not debit cards) for better fraud protection. Shop only on secure websites (look for "https://" and a padlock icon). Stick to reputable retailers you know. Never save your card information on websites. Consider using a dedicated credit card with a lower limit just for online shopping. Review your statements regularly for unauthorized charges. Some credit card companies also offer virtual card numbers for added security when shopping online.

-

How can I protect myself from phone scams?

Don't answer calls from unknown numbers - let them go to voicemail. Never give personal or financial information to someone who calls you unexpectedly. Remember that government agencies like the IRS or Social Security won't call you demanding immediate payment or information. Be skeptical of callers creating urgency or threats. If someone claims to be from a company you do business with, hang up and call them back using the number on your bill or their official website. Consider using a call-blocking app to reduce unwanted calls.