Employment & Income Opportunity Scams

Learn how to recognize and avoid fraudulent job offers and income opportunities that can cost you time, money, and personal information.

What are Employment & Income Opportunity Scams?

Employment scams lure victims with promises of easy money, flexible hours, or work-from-home opportunities that sound too good to be true—because they are.

These scams target job seekers of all ages, including retirees looking for supplemental income or flexible part-time work. Scammers use enticing but vague job descriptions, unrealistic salary promises, and minimal qualification requirements to attract as many victims as possible.

The scammers' goals typically include:

- Collecting personal information for identity theft (SSN, birthdate, bank details)

- Charging fees for "training," "certifications," or "starter kits"

- Getting victims to process fraudulent payments or transfer stolen funds

- Tricking victims into working without pay

- Using victims to help recruit other victims (as in pyramid schemes)

Common Types of Employment & Income Scams

Be aware of these common employment scam variations:

Work-From-Home Schemes

Promises of easy money working from home with minimal time investment. Common examples include envelope stuffing, assembly work, and data entry scams.

Often require upfront payments for "materials" or "training" with no real job opportunity.

Mystery Shopper Scams

Offers to pay you for evaluating retail stores, restaurants, or services as a "secret shopper." Often involves cashing fake checks and wiring money.

Legitimate mystery shopping jobs don't require upfront payments or processing checks.

Resume Fee Scams

Companies claiming to match your resume with employers for a fee, or charging to "optimize" your resume with promises of guaranteed interviews.

Legitimate employment services don't guarantee job placement or charge large upfront fees.

Fake Job Listings

Fraudulent job postings that collect personal information through fake application processes or interviews.

May impersonate legitimate companies to gain trust and request sensitive information.

Rebate Processor Scams

Claims you can earn money by processing rebates or completing forms online, but requires paying for "training" or "software."

These positions rarely exist in the real job market, especially as opportunities for independent contractors.

Pyramid Schemes & MLMs

Business models that focus on recruiting new members rather than selling actual products or services. Early participants may profit while later recruits lose money.

Often disguised as legitimate multi-level marketing opportunities.

How to Identify Employment Scams

Watch for these warning signs when evaluating job opportunities:

Job Listing Red Flags

Too Good To Be True

Unusually high pay for simple work with minimal qualifications or experience required.

Example: "$5,000/week working part-time from home, no experience needed!"

Vague Job Descriptions

Posting lacks specific details about responsibilities, required skills, or the company itself.

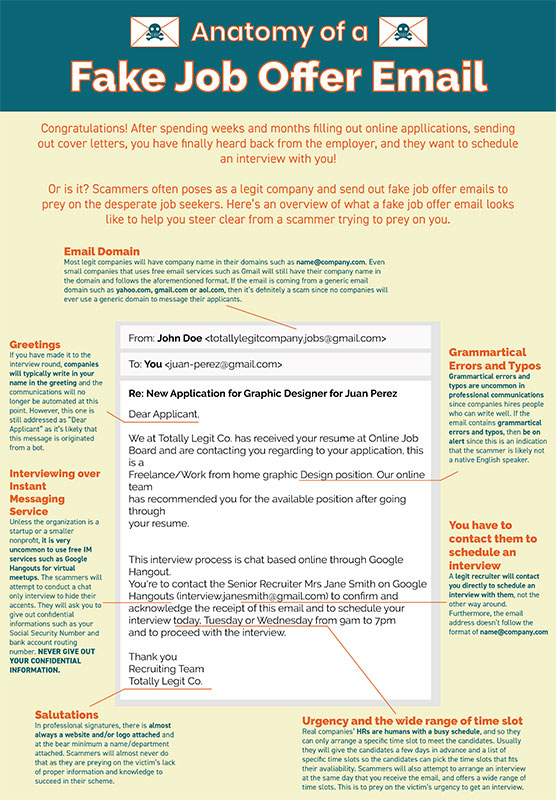

Unprofessional Communication

Emails with poor grammar, spelling errors, or generic greetings (like "Dear Applicant").

Personal Email Domains

Communication comes from personal email addresses (gmail.com, yahoo.com) rather than company domains.

Application Process Red Flags

Immediate Job Offers

Being hired without a proper interview or background check.

Example: "Congratulations! You're hired! We just need your banking information to set up direct deposit."

Requests for Upfront Payment

Requiring payment for training, supplies, software, or certifications before you can start working.

Premature Personal Information Requests

Asking for Social Security numbers, bank details, or copies of ID documents before a formal job offer.

Pressure to Act Quickly

Creating urgency to make you accept the position or provide information without time to research the company.

Anatomy of a Work-From-Home Scam

Let's examine a typical employment scam to identify warning signs:

Warning Signs in This Job Offer

Unrealistic Income Claims

Promises of very high income for part-time work with minimal effort—"$1,500/week for just 5-10 hours."

No Specific Skills Required

"No special skills or experience needed"—legitimate high-paying jobs typically require specific qualifications.

Upfront Payment Required

Request for payment to receive "training materials" or "starter kit"—legitimate employers don't charge new hires.

Vague Company Information

Limited details about the company, its history, or what it actually does.

Suspicious Contact Methods

Communication only through personal email or messaging apps rather than official company channels.

Who Is Targeted by Employment Scams?

While anyone can fall victim to employment scams, certain groups are particularly vulnerable:

Retirees & Older Adults

Employment scammers target retirees and older adults by:

- Offering flexible, part-time work opportunities that appeal to those seeking supplemental income

- Promising work that can be done from home, which appeals to those with mobility limitations

- Creating opportunities that sound well-suited for skilled professionals with decades of experience

- Advertising "consultant" positions that make use of career expertise without full-time commitment

Job Seekers

People actively looking for employment are vulnerable because:

- Financial pressure may make them more willing to take risks

- A long job search can lead to desperation and lowered skepticism

- They're already providing personal information in legitimate applications

- They're actively searching job boards where scammers post fake listings

- They may have public resumes online that scammers can use to target them

Those Seeking Flexible Work

People looking for work-from-home or flexible opportunities because:

- Caregivers who need to work from home while tending to family members

- People with health conditions or disabilities who need accommodation

- Those seeking supplemental income alongside other responsibilities

- People in remote areas with limited local employment options

- Those wanting to avoid commuting costs or time

Why Employment Scams Are Effective

These scams work because they:

- Target basic needs for income and financial security

- Exploit the trust people naturally extend to potential employers

- Take advantage of the standard practice of providing personal information during job applications

- Offer solutions to legitimate challenges like finding flexible work or supplemental income

- Often look very similar to legitimate job opportunities at first glance

How to Protect Yourself from Employment Scams

Follow these practices to safely navigate job opportunities:

Research Thoroughly

Before applying, research the company online. Look for a professional website, verified contact information, and reviews from current and former employees.

Never Pay to Work

Legitimate employers don't charge application fees, training costs, or require purchase of equipment to get hired.

Guard Personal Information

Never provide Social Security numbers, bank details, or copies of personal documents until you've verified the company and received a formal job offer.

Ask Detailed Questions

Request specific information about job duties, reporting structure, work hours, and how performance will be measured.

Insist on Live Interviews

Be wary of job offers without phone or video interviews. Request to speak with the hiring manager or potential teammates.

Use Reputable Job Boards

Search for opportunities through established employment websites that vet their listings and offer fraud protection.

The Golden Rule for Employment Opportunities

If a job seems too good to be true—high pay, minimal qualifications, flexible hours—it probably is. Legitimate employers don't need to make unrealistic promises to attract qualified candidates.

Finding Legitimate Flexible & Remote Work

How to identify legitimate opportunities for remote and flexible employment:

Legitimate vs. Suspicious Job Characteristics

| Legitimate Jobs | Suspicious Jobs |

|---|---|

| Clear, specific job descriptions | Vague descriptions with few details |

| Realistic salary ranges | Extraordinarily high pay for simple work |

| Formal interview process | Job offers without proper interviews |

| Verifiable company information | Limited or no online company presence |

| Professional communications | Emails with grammar errors or generic greetings |

| No upfront payments required | Fees for training, equipment, or certifications |

Trusted Resources for Remote Work

Reputable Job Boards Specializing in Remote Work

- FlexJobs (screens all listings for legitimacy)

- AARP Jobs Board

- We Work Remotely

- Remote.co

- LinkedIn (focus on established companies)

Common Legitimate Remote Positions for Seniors

- Customer Service Representative

- Virtual Assistant

- Bookkeeper or Accounting Clerk

- Online Tutor

- Freelance Writer or Editor

- Consultant in your area of expertise

- Transcriptionist

Tip: Check Company Reviews

Before applying, check websites like Glassdoor.com to read reviews from current and former employees to gauge the company's legitimacy and work environment.

What to Do If You Suspect an Employment Scam

If you encounter a suspicious job opportunity:

Before You've Responded

- Research the company through independent sources, not just links they provide

- Search the company name plus "scam" to see if others have reported issues

- Verify the employment opportunity by contacting the company through its official website

- Check with the Better Business Bureau for complaints or alerts

- Ask detailed questions about the position, company structure, and hiring process

- Trust your instincts if something feels wrong or too good to be true

- Report suspicious listings to the job board where you found them

If You've Already Applied or Interviewed

- Stop communication if you confirm it's a scam

- Don't send money for any reason, even if promised reimbursement

- Report the scam to:

- The Federal Trade Commission at reportfraud.ftc.gov

- The FBI's Internet Crime Complaint Center at ic3.gov

- Your state's attorney general's office

- The website or platform where the job was posted

- Monitor your accounts and credit report if you provided financial information

- Change passwords for any accounts you may have shared information about

- Document all communications for your records

Recovering Lost Money

If you've already paid money to a scammer:

- Contact your bank or credit card company immediately to report fraud

- Report wire transfers to the wire transfer company's fraud department

- File a police report with your local authorities

Protecting Your Identity During Job Searches

Employment scams often lead to identity theft. Follow these practices to protect your personal information:

Resume Safety

Limit personal information on public resumes. Consider creating a separate email address for job searching, and never include your Social Security number, birthdate, or full address on your resume.

Online Application Security

Check for secure websites (https://) before submitting information. Be cautious with job applications that request excessive personal details before an interview.

Monitor Your Credit

Regularly check your credit reports for unauthorized accounts or inquiries. Consider placing a fraud alert on your credit file if you suspect your information has been compromised.

When to Provide Sensitive Information

It's generally appropriate to provide personal information like Social Security numbers only:

- After receiving and accepting a formal job offer

- When completing official employment forms (W-4, I-9, etc.)

- Through the company's secure HR portal or in person

- After verifying the legitimacy of the company and position

Be especially cautious if asked to provide this information early in the application process or through insecure channels like email.

Helping Others Avoid Employment Scams

Share your knowledge to protect friends and family members:

When Someone Shares a Job Opportunity

- Offer to help research the company before they apply

- Ask specific questions about the job description and responsibilities

- Share information about common employment scam red flags

- Suggest they verify the opportunity through the company's official website

- Offer to review any communications or contracts before they commit

- Encourage them to trust their instincts if something seems suspicious

Community Awareness

- Share information about job scams at community centers or senior groups

- Alert others when you encounter scam job postings online

- Report scams to job boards and local authorities

- Share success stories about finding legitimate remote work through trusted channels

- Distribute our printable resources about employment scams

- If you work with seniors, include employment scam awareness in financial literacy programs

Supporting Job Seekers

Job hunting can be stressful, especially for those re-entering the workforce or seeking supplemental income in retirement. Offer emotional support and remind others that taking time to verify opportunities is a sign of wisdom, not skepticism.

Encountered a Suspicious Job Opportunity?

If you've come across a job offer that seems suspicious or if you've already shared personal information, we're here to help.