Banking & Financial Scams

Learn how to identify and protect yourself from scams targeting your bank accounts, credit cards, and other financial assets.

What are Banking & Financial Scams?

Banking and financial scams are deceptive tactics used by criminals to gain access to your financial accounts, steal your money, or commit identity theft using your financial information.

These scams specifically target the accounts where you keep your money and other assets. Scammers may impersonate banks, credit card companies, investment firms, or financial advisors to appear legitimate.

Common goals of banking scams include:

- Stealing login credentials to access your accounts

- Getting your credit card or debit card numbers and security codes

- Convincing you to transfer money to fraudulent accounts

- Installing malware to monitor your financial transactions

- Collecting enough personal information to open new accounts in your name

Common Types of Banking & Financial Scams

These scams come in several forms, each using different tactics to target your finances:

Account Alert Scams

Emails, texts, or calls claiming there's a problem with your account that requires immediate attention.

Scammers often claim your account has been compromised, locked, or has suspicious activity.

Fake Banking Apps

Counterfeit mobile banking applications that look identical to real ones but steal your login credentials and financial data.

These are often distributed through unofficial app sources or deceptive websites.

Card Skimming

Devices secretly attached to ATMs, gas pumps, or payment terminals that steal your card information when you insert or swipe your card.

May be combined with hidden cameras to capture your PIN.

Overpayment Scams

Scammers send you a fake check for more than the agreed amount, then ask you to refund the difference before the check bounces.

Common in online sales, rental deposits, or mystery shopping schemes.

Check Fraud

Counterfeit or altered checks that appear legitimate but eventually bounce, leaving you responsible for any money withdrawn.

May include fake cashier's checks, money orders, or personal checks.

Automatic Payment Scams

Fraudulent charges set up as recurring payments on your account, often starting with small amounts to avoid detection.

The scammer hopes you won't notice these regular withdrawals.

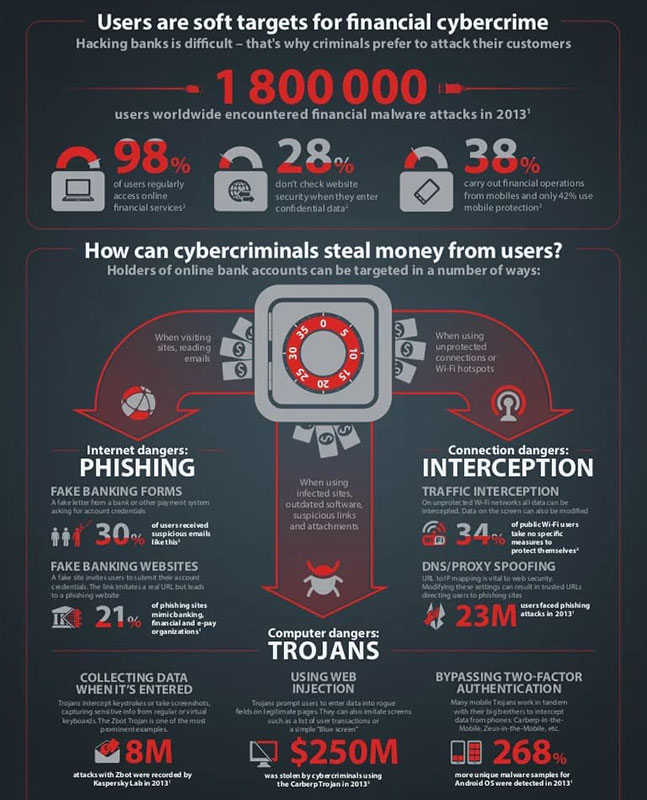

Why Banking Scams Are Effective

These scams use sophisticated techniques that make them particularly convincing:

Convincing Tactics Used

Professional Appearance

Scammers create emails, websites, and apps that look identical to legitimate financial institutions, including proper logos, formatting, and language.

Fear and Urgency

Messages create immediate concern by suggesting your money is at risk, requiring you to act quickly before you can verify the situation.

Technical Language

Using banking terminology and financial jargon to sound authoritative and legitimate, making the message seem official.

Personal Information Exploitation

Partial Information Inclusion

Including partial account numbers or personal details they've obtained elsewhere to appear legitimate and knowledgeable about your accounts.

Data Breach Exploitation

Using information from real data breaches to make their communications more convincing and personally targeted.

Timing Strategies

Sending messages at times when banks might be closed or customer service is unavailable, making verification more difficult.

Why Seniors Are Common Targets

Older adults are frequently targeted by banking scams because:

- They often have substantial savings, retirement accounts, or home equity

- They may be less familiar with digital banking security features

- Many grew up in an era when banking was conducted in person, making them more trusting of "official" communications

- They may be less likely to report financial fraud due to embarrassment

- Some may have cognitive impairments that make it harder to identify scams

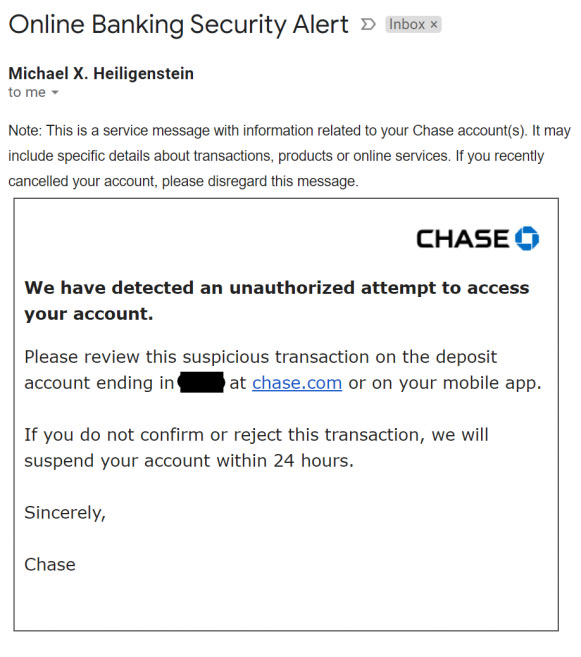

Anatomy of a Banking Scam: Red Flags to Watch For

Let's examine a typical banking scam email to identify the warning signs:

Warning Signs in This Email

Suspicious Sender Address

The email appears to be from a major bank, but the actual sender address is security@bankname-chase.com, not the official bank domain.

Urgent Action Required

"Immediate confirmation required" and "24 hours" create false urgency to pressure you into acting without proper verification.

Generic Greeting

"Dear Valued Customer" instead of using your actual name. Real banks typically address you personally in official communications.

Requests for Sensitive Information

Asking for full account numbers, passwords, PINs, or security codes—information legitimate banks never request via email.

Suspicious Link

The "Confirm transaction" button leads to a fake website designed to steal your login credentials.

How to Protect Yourself from Banking Scams

Follow these practices to safeguard your financial accounts:

Use Direct Navigation

Type your bank's website address directly into your browser or use their official mobile app instead of clicking links in emails or texts.

Verify Directly

If you receive an alert about your account, call your bank directly using the number on the back of your card, not numbers provided in messages.

Use Strong, Unique Passwords

Create different passwords for each financial account and consider using a password manager to keep track of them securely.

Enable Account Alerts

Set up notifications for all account activity, including deposits, withdrawals, and password changes, so you're instantly aware of unauthorized activity.

Use Two-Factor Authentication

Add this extra layer of security to your accounts so that access requires both your password and a temporary code sent to your device.

Review Statements Regularly

Check your bank and credit card statements at least monthly to spot unauthorized transactions, even small ones that might be test charges.

Banking Security Golden Rules

Real banks will NEVER:

- Ask for your full PIN or password

- Request security codes in an email or text

- Pressure you to transfer money to a "safe account"

- Ask you to download remote access software

- Send someone to your home to collect cash, cards, or checks

ATM and In-Person Banking Safety

Protect yourself when using ATMs and conducting in-person banking:

ATM Safety Tips

- Use ATMs in well-lit, public locations whenever possible

- Inspect the ATM for unusual attachments or devices before inserting your card

- Cover the keypad with your hand when entering your PIN

- Be aware of anyone standing too close or watching your transaction

- Never accept help from strangers at an ATM

- Check your surroundings before and after your transaction

- Opt for drive-up ATMs when available for added security

- Save and check your receipt to verify the transaction amount

Card Skimmer Awareness

Card skimmers are devices criminals attach to ATMs and payment terminals to steal your card information. Here's how to spot them:

- Look for anything loose, crooked, or damaged on the card reader

- Check if the card slot feels loose or looks different from normal

- Examine the keypad for unusual overlays that might conceal cameras

- Look for tiny cameras aimed at the keypad (often hidden in brochure holders or decorative elements)

- Compare the ATM to others nearby—legitimate ATMs from the same bank should look identical

- If something seems suspicious, use a different ATM and report your concerns

Consider Contactless Payments

Modern contactless payment methods offer security advantages over traditional card swiping or insertion. When possible, consider using:

- Contactless credit or debit cards

- Mobile payment apps (Apple Pay, Google Pay, etc.)

- Chip insertion rather than magnetic stripe swiping

Online and Mobile Banking Safety

Secure your digital banking experience with these essential practices:

Secure Account Setup

- Use Strong Passwords: Create complex, unique passwords at least 12 characters long

- Enable Two-Factor Authentication: Add this crucial second layer of security to all financial accounts

- Set Up Account Notifications: Request alerts for all transactions, password changes, and login attempts

- Use Security Questions Wisely: Provide answers that aren't easily found on social media

- Regularly Update Contact Information: Ensure your bank has your current phone number and email for security alerts

- Check Login History: Periodically review account access logs for unknown devices or locations

Safe Banking Habits

- Use Official Apps Only: Download banking apps exclusively from official app stores

- Avoid Public Wi-Fi: Never access financial accounts on public or unsecured networks

- Keep Software Updated: Ensure your devices, browsers, and apps have the latest security updates

- Log Out Completely: Always formally log out of banking sessions, don't just close the window

- Use Dedicated Devices: If possible, use a separate device exclusively for banking and financial activities

- Verify Website Security: Look for "https://" and the lock icon in the address bar before entering credentials

- Set Low Transaction Limits: Reduce daily transfer and payment limits to minimize potential losses

Phone Banking Caution

When calling your bank, be aware that scammers can spoof official bank phone numbers. If you receive a call from your "bank," hang up and call back using the number on your card or from the official website.

Real-World Banking Scam Scenarios

Be aware of these common banking scam scenarios:

What to Do If You've Been Contacted

If you receive a suspicious communication about your bank account:

Immediate Steps

- Don't respond to the message or click any links

- Don't provide any personal or account information

- Contact your bank directly using the official phone number on your card or statement

- Report the message to your bank's fraud department

- Do not download any attachments or software

- Take screenshots of suspicious messages for reporting purposes

- Check your accounts for any unauthorized transactions

How to Report Banking Scams

- Report to your bank's fraud department using the official contact information

- Forward suspicious emails to reportphishing@apwg.org and to the bank being impersonated

- Report to the FTC at reportfraud.ftc.gov or 1-877-382-4357

- Report text message scams by forwarding them to 7726 (SPAM)

- File a report with the FBI's Internet Crime Complaint Center at ic3.gov

- Alert credit bureaus if you suspect your financial information has been compromised

Bank Verification Tip:

When verifying a suspicious communication with your bank:

- Call the number on the back of your card, not numbers provided in the message

- Visit a branch in person if you're unsure about phone verification

- Use your bank's official mobile app to check for legitimate security alerts

What to Do If You've Been Scammed

If you've already responded to a banking scam or notice unauthorized transactions:

Act Immediately

- Contact your bank's fraud department immediately using the official number on your card

- Change your passwords and PINs for all financial accounts

- Request a freeze on affected accounts to prevent further transactions

- Request a new card if your card information was compromised

- Review account statements carefully for unauthorized transactions

- Enable additional security features such as two-factor authentication

- Document everything—save emails, texts, and record details of phone calls

Further Protection Steps

- Set up fraud alerts with the three major credit bureaus (Equifax, Experian, TransUnion)

- Consider a credit freeze to prevent new accounts from being opened in your name

- Monitor your credit reports for suspicious activity

- File an identity theft report with the FTC at identitytheft.gov

- File a police report for financial fraud, especially if money was stolen

- Check other accounts for suspicious activity, as scammers may target multiple accounts

Recovery Scam Warning

After experiencing a financial scam, you may be contacted by "recovery services" claiming they can get your money back for a fee. Most of these are secondary scams targeting victims. Legitimate recovery assistance comes through your bank, law enforcement, or consumer protection agencies—not random companies charging upfront fees.

Helping Vulnerable Family Members

Ways to protect elderly or vulnerable family members from banking scams:

Preventive Measures

- Discuss banking scams openly and without judgment

- Establish a verification system where they contact you before responding to financial requests

- Set up account alerts that notify both them and a trusted family member

- Consider account monitoring tools that allow secure oversight of transactions

- Help them set up strong security measures on their accounts and devices

- Create a list of official banking contact numbers to keep by their phone

- Consider simplified banking options that limit exposure to online risks

Legal Protections

For family members with cognitive decline or who are particularly vulnerable to scams, consider these additional protections:

- Joint accounts that allow monitoring of transactions

- Limited power of attorney for financial matters

- "View only" account access that allows family to monitor without making transactions

- Daily withdrawal limits to prevent large unexpected transfers

- Work with the bank to establish special fraud protocols

- Consider a trusted contact person, which many financial institutions now offer as an option

Important Note:

When helping vulnerable family members with financial security, always balance protection with respect for their independence and dignity. Include them in the decision-making process and choose the least restrictive options that still provide adequate security.

Think You're Being Targeted by a Banking Scam?

If you've received a suspicious banking communication or notice unauthorized transactions, we're here to help.